During the lifecycle and evolution of a startup, certain scenarios will make the founder feel the need for a Chief Financial Office (CFO) to lean on and collaborate with. This article describes such scenarios, explains why and when a startup may benefit from a Fractional CFO (part time) rather than a Full-Time CFO, what services may be expected of a Fractional CFO, and how to go about hiring the correct one for your startup.

Scenarios that may require the input of a CFO

- Rapid Growth: When a startup begins to scale quickly, the financial complexity of operating the business also increases. A CFO is equipped to manage this complexity, and will help streamline the financial operations during this pivotal phase.

- Investment and Fundraising: Startups planning to raise significant levels of funding or venture capital can benefit greatly from a CFO’s experience and expertise. They can provide insights into the fundraising process, present a compelling financial narrative to potential investors, and help maintain investor relations.

- Business Expansion: If a startup is planning to expand its operations, either domestically or internationally, a CFO will play a critical role. They can help with financial planning, risk assessment, and strategic decision-making related to the expansion.

- Exit Strategy: If a startup is preparing for an exit, either through an acquisition, a merger, or an IPO, having a CFO on board can be instrumental. They will guide the executive team through the financial aspects of these complex processes.

Hiring a CFO, however, is a major decision and doing so too early in your startup's lifecycle could have negative impacts. Most significant of which is the cost - CFOs, given their expertise and importance, command high salaries. For startups working within a limited budget, this expenditure may not be justifiable or sustainable, especially if the financial workload doesn't warrant a full-time CFO.

This is where the notion of fractional CFOs comes into play. A fractional CFO serves as a flexible and cost-effective solution for startups not ready to commit to a full-time CFO, but requiring strategic financial insights. They offer a high level of expertise and are particularly effective for startups experiencing rapid growth or gearing up for significant changes such as fundraising or business expansion.

Services provided by a Fractional CFO

Depending on the stage of the startup, a fractional CFO may provide a subset of the following services:

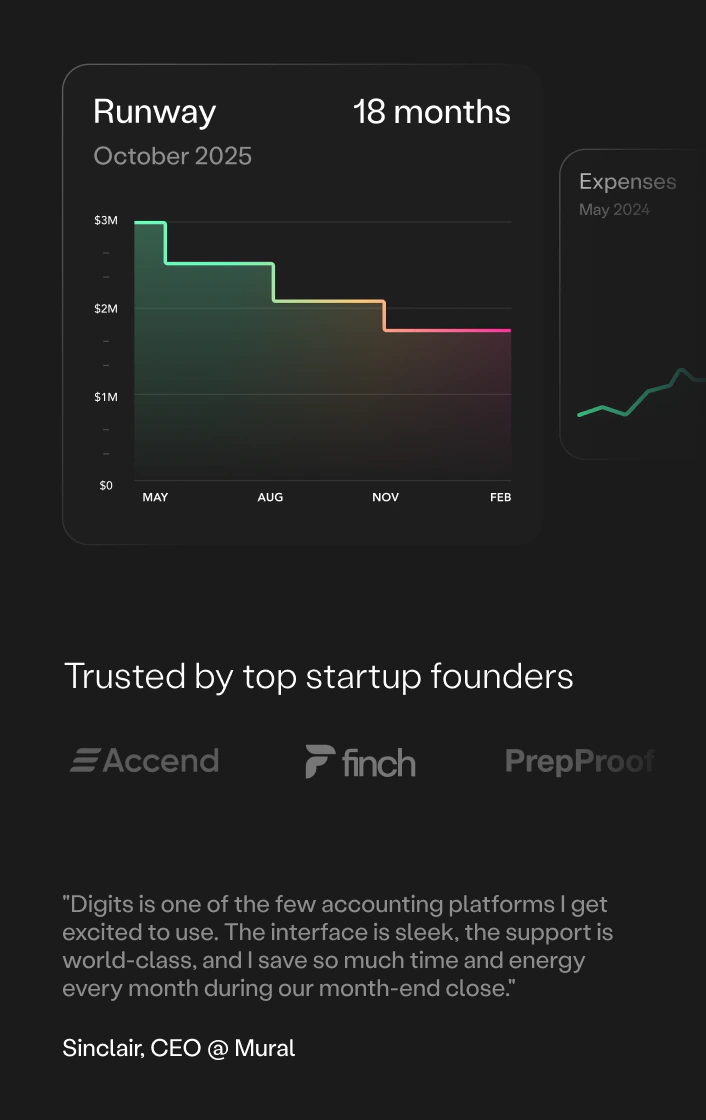

- Financial Forecasting and Modeling: Important for budgeting purposes and investor relations, a fractional CFO can develop short-term and long-term financial forecasts to predict the company's financial performance.

- Budget Planning and Management: This involves creating detailed operating and capital expenditure budgets that align with the strategic plans of the startup. A CFO ensures these budgets are adhered to and makes necessary adjustments as the business progresses.

- Cash Flow Management: Cash flow is vital for early-stage startups. Managing income, expenses, and ensuring there is always sufficient liquidity to meet the organization's obligations is a task a fractional CFO can effectively handle.

- Capital Structuring and Fundraising: A fractional CFO guides startups through fundraising rounds by preparing detailed financial documentation, determining the right pricing for shares, and liaising with potential investors.

- Financial Risk Management: A fractional CFO can identify potential financial risks and develop strategies to mitigate these risks. This will protect the startup from unfavorable financial scenarios in the future.

- Compliance: Ensuring the startup meets all regulatory requirements and adheres to financial compliance is another critical task a fractional CFO can oversee.

How to identify a good Fractional CFO?

Hiring a fractional CFO is a crucial decision that can significantly impact the future of a startup. Understanding what to look for in a strong fractional CFO candidate can help ensure that a founder chooses the right person for the role. Here are some key features to consider:

-

Relevant Experience: Look for candidates that have relevant industry experience, preferably with tech startups. If they have worked with startups at the same or a similar stage as yours, they will understand the specific challenges and opportunities you're likely to face. For example, if your startup is planning to raise funds, consider candidates who have proven experience in fundraising

- Do you need a specialist? If your startup operates in an industry such as biotechnology or hardware manufacturing, there may be nuances specific to the industry that impact capital and cash flow needs. In such cases any viable candidate should have past experience in the specialized area.

-

Solid Financial Expertise: Strong candidates should have robust financial and accounting knowledge, including financial planning, cash flow management, financial reporting, and regulatory compliance.

-

Communication Skills: Your fractional CFO will need to translate complex financial concepts to non-financial team members, investors, and potential partners. Therefore, strong and clear communication skills are essential.

-

Compatibility: It is essential that the fractional CFO fits well with your company culture. They need to be able to work well with the executive team and understand the dynamics of a startup environment.

-

Strategic Mindset: A good fractional CFO is not just a numbers person. They should have a strategic mindset that can contribute to your startup's overall strategy and direction. They should be able to use financial data to provide strategic advice and make informed decisions.

-

Availability: Given that your fractional CFO is very likely to be a fractional CFO for multiple other clients, it is crucial that you ensure that they have the bandwidth to make themselves available to your fluctuating needs.

Identifying strong candidates is an integral part of the hiring process, taking the time to ensure you make the right choice will benefit your startup in the long run.

How much should you expect to pay a Fractional CFO?

There are two common ways that a fractional CFO is compensated - hourly rate or monthly retainer fee.

The payment structure that is right for a given startup will likely depend on several factors, such as the size and complexity of the business, the CFO's experience and expertise, the geographical location, and the scope of work involved.

If an hourly rate makes more sense for a given startup-CFO relationship, the startup should expect to pay somewhere in the $150 - $500 range per hour.

Monthly retainer fees typically vary in the $2,000 - $10,000 range and guarantee somewhere in the neighborhood of 10 - 50 of your partial CFO’s hours over the course of the month.

Remember that the cost of hiring a full-time CFO is significantly higher, especially when taking benefits and bonuses into account. Therefore, hiring a fractional CFO can often be a cost-effective solution for startups that require strategic financial input but cannot justify or afford a full-time CFO role.