Accounts receivable (AR) is all about the outstanding money owed to your business for either goods or services received, but not yet paid for, standard practice for a lot B2B transactions and startups, especially in the SaaS space. Sounds simple, right? Below we’ll dive deeper into the ins & outs of AR and how it might play a role in your startup’s financial journey.

Keeping Track of the Owed Amounts

Creating an environment where customers pay you on credit undoubtedly leads to an increase in sales. But, it also means you’ll have to start keeping track of who owes you, how much, and when that money is expected. To take care of this, you should establish an AR recording system or aging report — more on these below.

Through regular updates to this report, you will always be aware of who has paid and who is yet to pay. This will help you manage your cash flow accurately and ensure financial stability for your startup.

What’s an AR aging report?

The AR aging report is your secret tool to organize your cash flow effectively. Like a well-formulated spreadsheet, it's divided into different categories based on the length of time an invoice has been outstanding. Usually, these categories are: 'Current', '1-30 days overdue', '31-60 days overdue', '61-90 days overdue', and '90+ days overdue'. This report provides a clear picture of your overall accounts receivable situation and helps you identify late payments at a glance.

The Depth and Breadth of AR Management

Effectively managing your accounts receivable isn't just about record keeping. It involves a combination of proactive strategies like credit management, collection strategies, and regularly evaluating your AR processes.

A robust credit management policy precedes a healthy AR system. Before you extend credit to a customer, assess their creditworthiness to see if they can pay back within the agreed time. Employ different collection strategies to encourage timely payments, from sending friendly reminders to imposing late payment fees where necessary.

Why Should You Care About AR?

You might wonder why all this hullabaloo about AR? Here’s why: Poorly managed receivables can significantly impact your cash flow, making it hard to meet operational expenses. Efficient AR management assures a steady stream of income, thereby helping your fledgling company grow and stay afloat in the challenging business landscape.

Technology to the Rescue

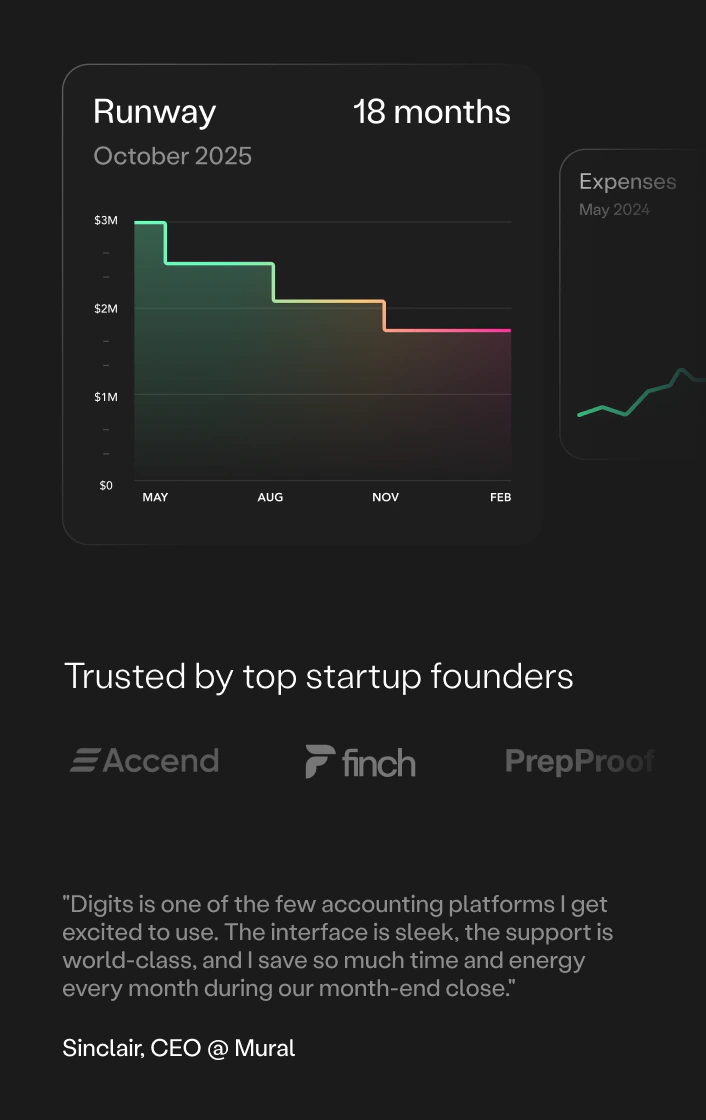

Keeping track of your startup's accounts receivables can be taxing. As the company scales, so will the AR complexities. Luckily, accounting services and a myriad of tools, can help streamline things remarkably.

Such technologies automate the AR processes, reduce time spent on tracking payments, and empower quick responsiveness to late payments. All of these ensure a healthier cash flow and can give you the time needed to focus on growing your startup.

Keep on Counting

Accounts receivable might seem mundane amidst the exciting world of startups. However, early focus and management of AR can set the foundation for smooth financial operations, stability, and cash flow transparency. A startup that has its financial facets well-orchestrated is one step closer to success.