We are obsessed with the vision that business finance should be immediately accessible and intuitive. It should learn, in real-time, as the business evolves, and it should empower business owners and operators everywhere, without requiring any prior financial training.

Why? Because today’s business climate requires you to take action in the moment and react rapidly to changing market conditions. That means not waiting weeks to receive a standard packet of black & white financials—which honestly can be quite difficult to interpret—and instead demanding the visibility and insight you need to make decisions, right now.

The Power of Digits

The world’s largest companies have sophisticated finance teams and internal forecasting models that give them these capabilities. What about everyone else? What if synthesized, actionable financial insights were available to every business on earth? What if they were always in real-time, and always up-to-date?

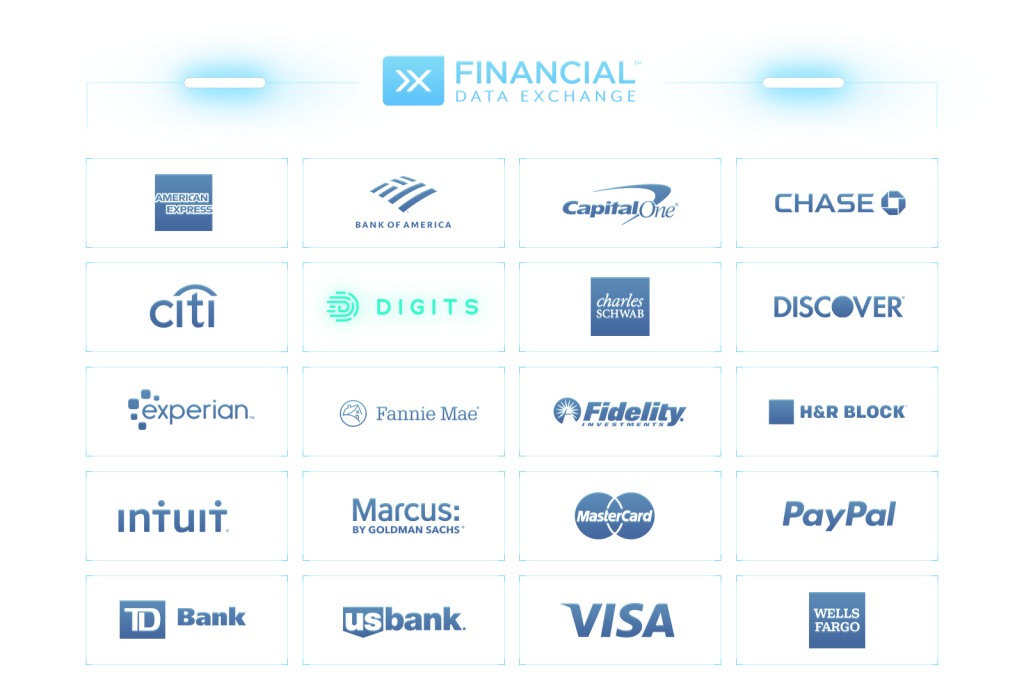

For two years, we’ve been building the technical infrastructure to make this a reality: N-dimensional transaction attribution. Auto-reconciliation. Predictive classification. Vendor identification and profile synthesis. Sub-second, full-ledger search. Statistical analysis and anomaly detection. Per-secret envelope encryption. The list goes on.

Introducing Digits, for Expenses

We’ve been humbled by the glowing feedback from our early customers and we’ve been inundated with requests for access. And, in these unprecedented times, we feel the obligation to help as many business owners as we can, as quickly as possible.

So today, we’re launching a broad early-access program for Digits for Expenses. We’ve taken all of the power of our platform and focused it specifically on helping business owners navigate today’s challenging market dynamics, so they can see and manage how their company is spending money:

*Digits is a phenomenal and truly game-changing product. To be able to ask such a wide spectrum of financial questions and get to those answers immediately has been so empowering, and the team’s passion for the space is clear in all the small details.*

Thinking back to a finance world before Digits… feels like remembering Netflix as a DVD-by-mail service.

– Kenny Mendes, **Head of Finance, People, and Operations**

Digits for Expenses is the first real-time, intuitively visual, machine-learned expense monitoring dashboard for small businesses, and in light of current conditions, we are making it Free.

(Seriously. We have other paid products on our roadmap, but Digits for Expenses is and will continue to be free for all small businesses. In this quarantine, it’s the least we can do.)

GV leads $22M Series B

As we’ve built Digits, we’ve been overwhelmed by the energy and excitement for our mission from founders, accountants, and investors alike, and we’ve been honored to have the financial backing of Benchmark and over 70 passionate angel investors.

We see this as a long-term, sustained effort, and Digits for Expenses is just the first chapter: we believe that innovations in technology, algorithms, and design have unlocked a new realm of possibility for financial software, and we are committed to making this vision a reality for businesses around the world.

In support of this, we’re excited to share that we have closed $22M in Series B funding, led by Jessica Verrilli at GV, and we’re thrilled to welcome her to our Board. Jessica’s deep experience in corporate development at Twitter and in early-stage investing through GV and #Angels have given her unique insight into the challenges small businesses face during their most-defining moments, and we’re looking forward to imbuing the product with her knowledge.

*Jeff and Wayne are masterful at creating intuitive, high-utility products from complicated data. I saw this up close with Crashlytics and Twitter, and I’m thrilled to partner with them on Digits as they reimagine financial software for startups.*

– Jessica Verrilli, **General Partner**

This round gives us the stability we need to become the partner that businesses can trust: at current burn, Digits’ runway now extends over 10 years.

$8+ Billion and counting…

When we announced our Series A in November, Digits’ production systems saw over $1.5 Billion in transaction value across our early customer base. Today, that number is already over $8 Billion, and growing daily.

Digits for Expenses is available today, for free, for US-based startups and small businesses. We plan to add support for international markets later this year.

Digits takes just a few clicks to set up, and sits on top of your existing ledger and your existing accountant’s work—you change nothing. Sign up here to get started.

(If you’re an investor, startup incubator, or accounting firm and want priority access for your portfolio companies, contact us at partnerships@digits.com.)

With Thanks,

As founders, we would like to thank the entire Digits team for their tireless work over the past two years to bring us to this point. We still see this as just the beginning of our Digits journey, and we look forward to building powerful tools to help businesses of every shape and size chart their course.

We can’t wait for you to experience Digits, and we can’t wait to hear what you think.