Understanding Depreciation: A Comprehensive Guide for Startups

Team Digits

Team Digits

What is Depreciation?

In simple terms, depreciation is an accounting method that allows a company to spread the cost of an expensive purchase over a period of time, rather than all at once. This not only eases the immediate financial burden but also smooths out expenses over time. This process is vital for budget planning, particularly for start-ups, as it enables more predictable financial management.

An item's depreciation timeline is primarily based on its estimated 'useful life' - the period during which the asset can provide value. For example, a start-up founder who purchases a laptop for $5K may depreciate the cost over the laptop's five-year lifespan. Though the money leaves your bank account immediately, spreading out the expense in your finacials helps manage and forecast cash flow effectively. Remember, tax rules may specify different asset classes, each with its own predetermined lifespan, which further influences how depreciation impacts a company's financials.

Decoding Assets

Simply put, an asset is anything of long-term value to the business. Assets could be tangible like a vehicle, machinery or office equipment, or intangible such as patents or copyrights. Both types of assets can depreciate over time - though with intangible ones, it's referred to as amortization.

The Criteria for Depreciating Assets

There are certain guidelines set by tax authorities on which assets can be depreciated. The conditions typically include:

- The asset is owned by you

- The asset is used for business or income producing purposes

- There is a usable life for the asset which can be measured

- The asset would last for more than a year

Examples include vehicles, real estate, equipment, office furniture, and computers among others.

The Lowdown on a Depreciation Schedule

A depreciation schedule essentially illustrates the amount each asset will depreciate annually. It usually contains:

- A brief description of the asset

- Purchase date

- Purchase price

- Expected life span

- Depreciation method used

- Salvage value (what you can sell it for after its useful life)

- Depreciation amount to be written off for the current year

- The cumulative depreciation amount

- The resultant value of the asset after depreciation (purchase price minus any cumulative depreciation)

Demystifying Depreciation Types

While there are several methods to depreciate your assets for your books or financial statements, the depreciation expense on your books may differ from what you deduct on your tax return. Let's walk through the most prevalent types.

Straight-line Depreciation

This is the most common method where you equally distribute the value of an asset over its useful life period. It's ideal for small businesses without complicated accounting systems. Here’s an example:

You buy a dessert stand for your bakery for $5,000. It has a $500 salvage value and a useful life of 5 years. Using the formula: (asset cost – salvage value) / useful life, the annual depreciation would be $900.

Double-declining Balance Depreciation

This is a slightly more complex method allowing higher value write-off during the early years after purchase with lesser in the later years. It often applies to businesses wanting to recover more of the asset’s value upfront because the asset loses value quickly in the first few years of ownership.

Sum-of-the-year’s-digits Depreciation

This method similarly offers more write-off in the early years of an asset's life. It involves making calculations using the lifespan of an asset to find the depreciation amount.

Units of Production Depreciation

This method is best when depreciating equipment based on its workload or "units of production". This method, which involves monitoring the usage of equipment, is typically used only for machinery or equipment of high value due that additional work required.

Modified Accelerated Cost Recovery System (MACRS)

MACRS is a depreciation method widely used in U.S. tax depreciation. This system assigns assets to specific classes that consequently determine the asset's useful life span. For MACRS depreciation, examples of accepted methods include the Double Declining balance and Sum of the Years’ Digits method. For a comprehensive list and details of asset classes, IRS Publication 946, Appendix B is a great resource.

Final Thoughts

Understanding the art of depreciation is essential for startups because it can be a strategic and savvy approach to decreasing your tax liabilities over time. We advise speaking with a tax professional to consider all options before choosing a depreciation method. Calculate wisely, choose strategically, and embrace your financial journey!

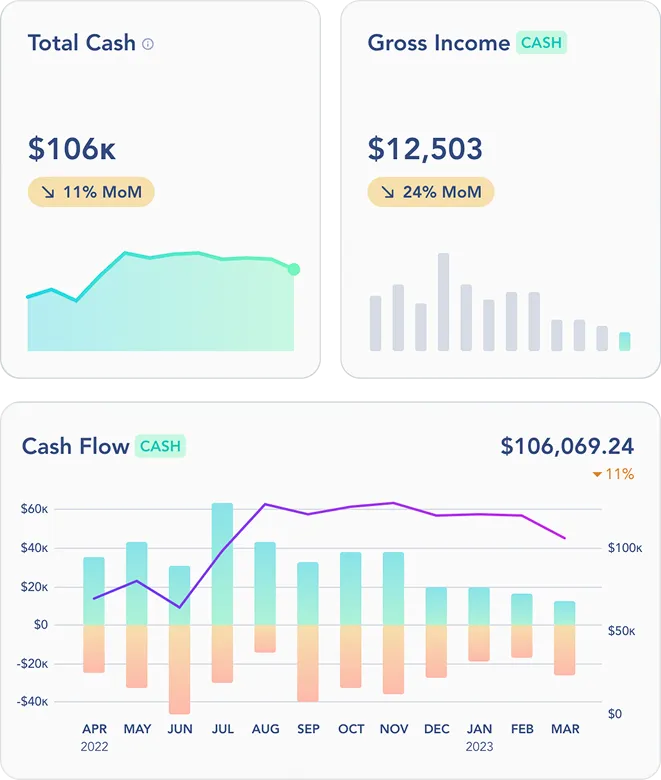

Despite the complexity of depreciation, mastering it helps to ensure your financial stability over the long run. But remember, you're not alone in navigating these complexities. Give Digits a try – we're here to simplify your experience with depreciation and other financial matters, leaving you free to focus on growing your startup. Kick start your journey with Digits today.